- ENQUIRE ONLINE OR CALL US

- 08 8451 1500

Positive cash flow, capital growth and instant equity

Fixed rate home loans now from only 3.69%

If you own an investment property [or a few] we’d like to help.

The truth is most investors can’t really tell you how well their investment property/portfolio is performing at any given time…

…at least with any real degree of precision.

Sure, you’ll probably remember what you originally paid for your investment property, how much rent you’re getting, approximately what your loan repayments are each month and perhaps that you’ve built up some equity in the property over time, but that’s usually about as far as it goes.

As a property investor ‘knowing the numbers’ is very important, especially if you want to maximise your returns and continue growing your wealth – that’s why it’s important you’re able to answer questions like these ones;

- How much does your property cost you each week/month to hold, both before and after all cash deductions and depreciation has been taken into account?

- What is your gross and net rental yield and is it higher or lower than the area average for similar sized property?

- Is your property positively geared? If so, what level of income are you generating each week and how are you using those funds to your advantage?

- Is your property growing in value faster or slower than other similar sized properties in your surrounding area?

- Taking into account rent and capital growth what is the overall rate of return you are currently achieving with your property?

- What overall return have you made on all the money you have invested to date in your property?

- Is your property a good investment? Would you be better off to sell your investment property and buy something else in a different location?

- What is the current value of your property and how much [available] equity do you have?

- Do you have the capacity to buy another investment property? Should you buy another property?

- What interest rate are you paying on your investment loan/s? Could you get a better deal? If so, how much could you save in loan interest?

- Are you charging enough rent for your investment property? Could you get more? If, so how much more?

- Are you paying too much in property management fees? Could you get a better deal? If so, how much could you save?

- Have you had a proper depreciation schedule prepared for your property?

- Have you fully maximised every possible deduction for your investment property?

- What else could you do to improve the overall return on your investment property?

- How would a change [higher or lower] in your current rental income, loan interest rate, property management fees and/or capital growth effect your overall property investment returns?

Free Property Investment Performance Review

If you currently own an investment property, then we can help you answer all the above questions and more.

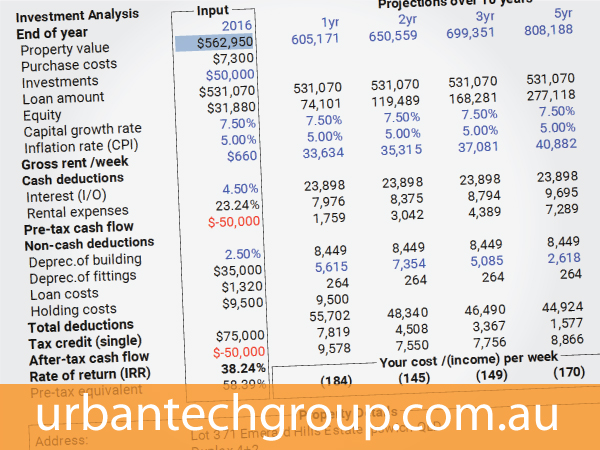

Using our property investment analysis [PIA] software, we can perform in-depth analytics on your investment property to let you know exactly how it is performing.

We’ll analyse the capital growth, cash flows, and ongoing tax implications of your investment property and provide instant feedback on the projected after-tax cost [or profit] and the overall rate of return.

Our software will also compute cash flow projections for up to 40 years and has facilities for changing more than 100 variables including; property price, rent, capital growth, inflation, rental expenses, interest rates, loan type, personal income and more. The internal rate of return [IRR] and the cost-per-week are recalculated automatically whenever a change is made which lets us perform sensitivity analysis and explore a range of ‘what if’ scenarios.

You’ll also receive a personalised 12-page property investment analysis report detailing every single financial aspect of your investment property. This report includes: analysis & graphs showing property costs, rent, rental expenses, total tax deductions, tax rebates, real per week cost to own, and return on investment.

As part of the performance review process we’ll also review your home & investment loans to ensure you’re not paying too much. Banks often offer new customers better rates so at the very least we’ll see if we can negotiate a better deal for you with your current lender.

And we can even arrange to have your properties revalued for free to see if they’ve increased in value and to determine how much equity you have available for further investment.

>> To arrange a free property investment performance review please contact Sam – sam@urbantechgroup.com.au or 0411 431 391

Don’t own an investment property?

Join our Real Investar Coaching Program and we’ll help you get started.

As part of the program we help you build a personalised investment plan based on the amount of passive income you want to achieve from your property portfolio.

Then it’s our job to help you execute your plan. We do this by assisting you to build a portfolio of cash flow positive property located in high growth areas.

If you need any other details or just want to chat further, please don’t hesitate to contact us any time.

Cheers

Sam & Matt

Urbantech Group

Adelaide Mortgage Broker +plus more…

PS. We’ve condensed all of our best finance and property investment tips, tricks and strategies into a 7-part article series – all links here. We’ve also created a property investment program to help you eliminate your bad debts and build a passive income of at least $83,200 by buying only 4 average-priced investment properties. For all details and to get started click here

Note: All property investment education and advice is provided by Urbantech Property Pty Ltd [ABN: 65 127 477 490] trading as Real Investar. Real Investar does not provide financial advice or credit advice.